A Detailed Brief On Leave Encashment And How It Is Calculated

Table of Contents

One of the key elements that enables employees to attain a healthy work-life balance is leave. Taking a full break from work enables employees to decompress and avoid burnout. Recognizing this, businesses all around the world have been offering their staff plenty of leave. While certain employees store up their leave and run the risk of not using it, others look forward to this time off.

Have you ever considered the possibility of earning extra money with the stored leaves? The employed class is acquainted with the idea of leave encashment, which provides a way for employees to receive money from unused paid time off.

What Is Leave Encashment?

The term “leave encashment” describes the payment or reimbursement received in exchange for unused time off. When quitting the company, retiring, or staying on the job, employees can cash in their accrued leave at any time throughout their employment, subject to the policies of the company. While certain private companies compensate employees for unused leaves in the subsequent fiscal year, most private organizations rely on their managers.

Conversely, some companies let employees roll over any unused holiday time into the following year. Any unclaimed paid time off is reimbursed to the employee by their manager when they quit.

Types Of Leaves In Leave Encashment

Casual Leaves: There are seven to ten days accessible for casual leaves. These leaves are available for use by employees for private purposes. The employee is required to notify the manager in advance of any planned casual leave, including the anticipated number of days or period of the leave. If it can be carried forward in accordance with company plans, it will be taken into consideration for leave encashment.

Privilege Leaves: The employee can obtain this time off by giving their manager advance notice of the leave. The manager approves and pays for the leave. The employee can save up and redeem these leaves at a later time if they are not used. All organizations, nevertheless, have their distinct set of policies concerning the encashment of privileged leave.

Medical Leaves: If an employee becomes unwell and is unable to work, they are entitled to medical or sick leave. The employee will need to present medical proof if they take more than three consecutive days of medical leave in a row. Laws mandate this kind of leave, and companies are required to provide a maximum of fourteen days of medical leave annually. The majority of companies do not permit the encashment or forwarding of accumulated medical leave to the subsequent year.

Maternity Leaves: Maternity leaves are only available to female employees, and they can be taken for a maximum of 12 to 26 weeks when they are pregnant. Employees can request extra time to relax if necessary. For the prolonged duration, the manager wouldn’t be obliged to pay anything.

Holiday Leaves: Holiday leaves are paid leaves, and employees’ salaries are not deducted. Festivals, weekly off, and national holidays are examples of holidays. These holiday time-off benefits are enjoyed by employees in all industries. These are taken into account when encashing leaves.

Sabbaticals: Companies provide sabbaticals to staff members who intend to take specific training to advance their knowledge and skill set. They are also able to enroll in long-term programmes at universities and accept any kind of specialized training or seminar that is pertinent to their line of employment. Sabbaticals are paid breaks that can be redeemed at any time.

How To Calculate Leave Encashment?

Now, let’s study the leave encashment estimation using a real-world scenario with Mr. Ram, who is leaving his job after two decades of service.

- During his employment, he was eligible for 25 days of paid time off per year, for a cumulative total of 500 days of leave.

- Throughout this time, Mr. Ram has already used 150 days of paid time off, leaving him with a total of 350 days of unused leave remaining.

- Mr. Ram will receive ₹35,000 per month in compensation upon retirement, which will consist of a dearness allowance (DA) in addition to his regular income.

The process of calculating leave encashment involves multiplying the total number of unused days of leave by the regular salary rate, which can be found here:

Salary per day = Total Monthly Salary / Number of Days in a Month Salary per day = 35,000 / 30 = ₹1167 (approximately)

The leave encashment amount can now be calculated as follows:

Leave Encashment Received = Number of Unutilized Leave Days * Salary per Day Leave Encashment Received

= 350 * 1167

= ₹4,08,450

As a result, Mr. Ram is qualified to receive ₹4,08,450 as encashment for his leave.

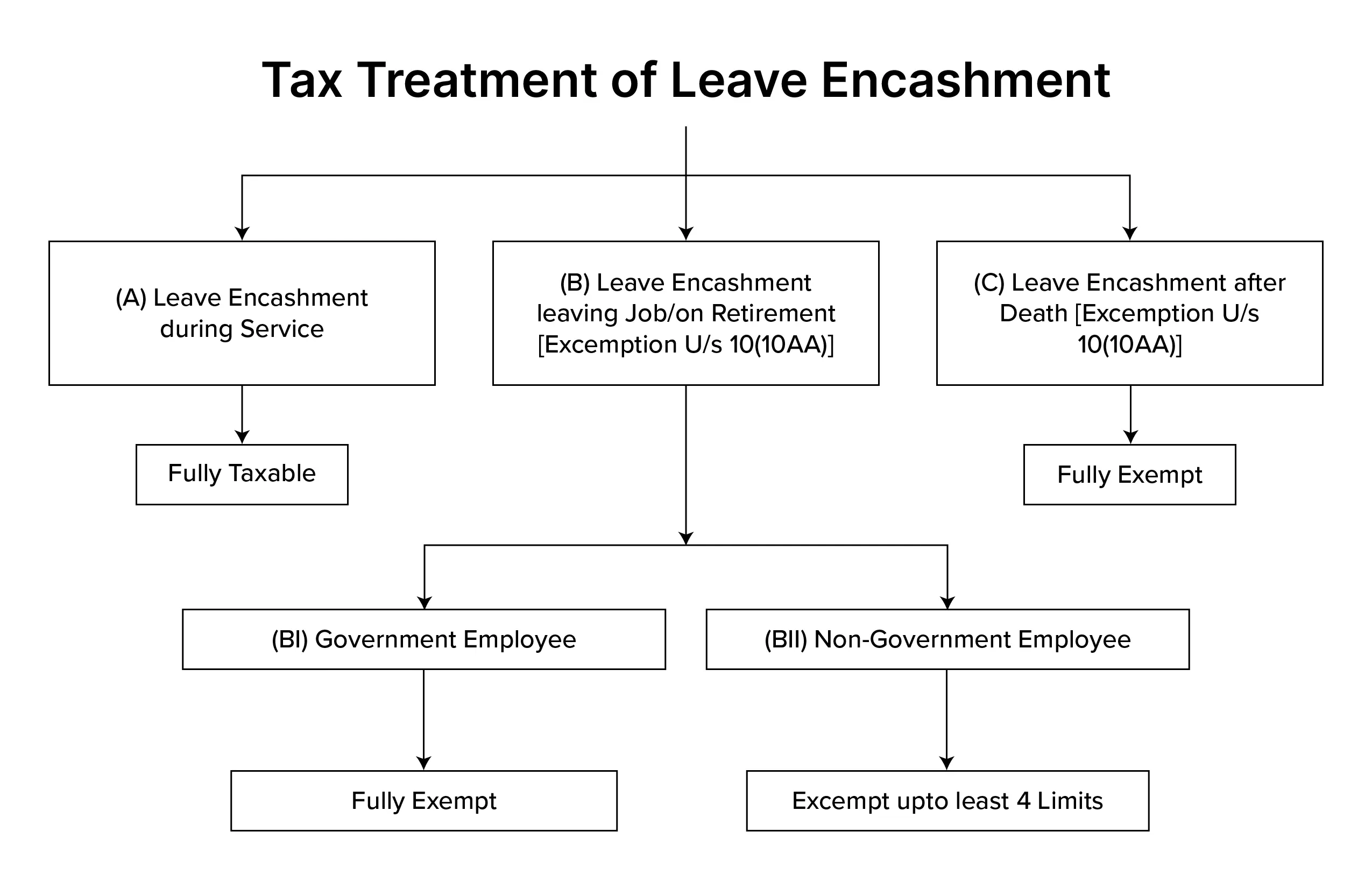

Taxation of Leave Encashment

Leave Encashment During The Employment Period

Since leave encashment is regarded as revenue from salary, any employee who requests to have their unclaimed paid time off throughout their service tenure be subject to taxation. Under Section 89, the employee is eligible for tax reduction in this situation. The employee may be eligible for tax reduction on the sum that they get via the leave encashment procedure, in accordance with Section 89. The employee must complete form 10E in order to receive tax reduction for encashment of leave. This application can be completed and filed electronically via the income tax agency’s e-portal.

Leave Encashment At The Time Of Retirement Or Resignation

Finance Minister Nirmala Sitharaman stated in the proposed budget for the fiscal year 2023–2024 that the ₹3 lakhs tax-exempt limit on leave encashment upon retirement for private salaried staff was last established in 2002 when the maximum monthly government basic pay was ₹30,000. “I am proposing to raise the limit to 25 lakh in accordance with the rise in government salaries,” she declared.

What is Income Tax Exemption Under Section 10(10AA)?

Certain sources of revenue are excluded from a person’s entire income when computing their tax liability. Section 10 of the Income Tax Act of 1961 lists all of the benefits that are available to taxpayers when filing income taxes.

- Any money obtained as leave encashment while an employee is at work is fully taxed in all ways. Nonetheless, the employee may be able to deduct taxes from the total amount of their leave encashment under Section 89 of the Income Tax Act.

- Any money obtained as Leave Encashment during retirement: Employees of the Federal Government or any State Government are free from paying any taxes on leave encashment. Up to a specified sum, or the average income of 10 months, every leave encashment that the employee receives is exempt. Basic pay and dearness incentives are included in the compensation. The amount of compensation earned is also taken into account. According to the pay they received in the ten months before their resignation or retirement, the salary of ten months is taken into consideration.

Benefits Of Leave Encashment

- The money received for encashing a leave of absence is charged if the employee is still employed.

- Regardless of whether they work for the government or the private sector, the amount accumulated on the account is fully reimbursed to the departing employee in the event of a termination or resignation.

- The cash value or amount received towards leave encashment is classified as payroll revenue and subject to a slab tax under income tax legislation.

- Employees won’t squander their leave time, and they can use it for more income.

- The yearly process of encashing leaves is done without set guidelines.

Conclusion

Leave encashment is an essential component of employee well-being in addition to being a monetary reward. The comprehension of the idea, keeping abreast of regulations, and skillfully handling leave encashment are all important factors in enhancing employee happiness and engagement. When businesses implement varied leave programs, employees should be aware of the tax ramifications so they can utilize and cash in their leaves with knowledge.

The work contract includes information about leave encashment, thus it’s critical to comprehend it. Employees who understand how leave encashment operates will be better able to schedule their vacation time and make the most of their leave perks.